Ecb Deposit Rate

Ecb Deposit Rate Forecast

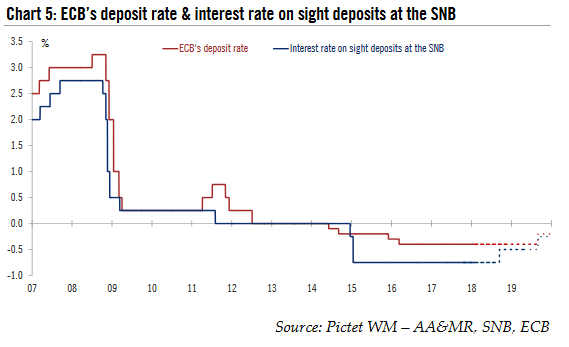

The two other key ECB rates are the overnight deposit rate (-0.20%) and the overnight marginal lending rate (0.30%). The first is the interest rate paid by the ECB to banks having a deposit (for the moment, it is the opposite because the rate is negative). The ECB left its key deposit facility rate unchanged at -0.5% on January 21st 2021 as expected. Deposit Interest Rate in the Euro Area averaged 1.27 percent from 1999 until 2021, reaching an all time high of 3.75 percent in October of 2000 and a record low of -0.50 percent in September of 2019. This page provides - Euro Area Deposit Interest Rate- actual values, historical data, forecast.

Let’s start at the beginning. The main key ECB rate is the refinancing rate. At the time of writing, the ECB refinancing rate is 0.050%, its lowest level ever. What does this 0.050% rate mean?

Ecb Policy Rate

To keep the prices stable (inflation below, but close to, 2%) the European Central Bank uses several monetary policy instruments to steer interest rates and manage banking liquidity. The most traditional operations are what we call the Main Refinancing Operations (MRO). When liquidity is needed, a bank can borrow directly from the ECB. Every week, banks of the Eurozone go (virtually) to the ECB desk to borrow money at the refinancing rate fixed by the ECB (0.050%). The loan is made under the form of a Repurchase Operation (Repo). The bank sells security assets to the ECB and borrows money. One week later, the bank gives the money back with interest to the ECB and recovers its security assets.

Ecb Interest Rate History

The two other key ECB rates are the overnight deposit rate (-0.20%) and the overnight marginal lending rate (0.30%). The first is the interest rate paid by the ECB to banks having a deposit (for the moment, it is the opposite because the rate is negative). The second is the rate paid by banks to the ECB when they want to use overnight credit outside the refinancing operations.